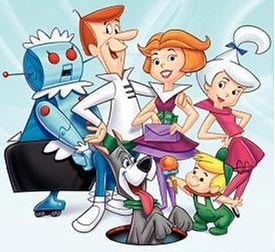

Some of you may remember the Jetsons, the television animated sitcom about a futuristic family whose everyday life was made easier by flying cars, moving walkways, and electronic gadgets galore. Indeed, some of the tech-driven devices that seemed most fantastical in the 1960s when the show debuted are a reality today—namely flat-screen TVs, video chat, digital newspapers, smartwatches, and, of course, robots.

Some of you may remember the Jetsons, the television animated sitcom about a futuristic family whose everyday life was made easier by flying cars, moving walkways, and electronic gadgets galore. Indeed, some of the tech-driven devices that seemed most fantastical in the 1960s when the show debuted are a reality today—namely flat-screen TVs, video chat, digital newspapers, smartwatches, and, of course, robots.

In our business, there’s been a lot of chatter about robo-advisors, which provide digital financial advice based on mathematical rules or algorithms. According to Cerulli Associates, robo-advisor platforms have racked up more than $71 billion in assets under management through the third quarter of 2016. Taking a big-picture look, that figure is expected to climb to $489 billion by 2020, and represent roughly 22 percent of all assets managed by registered investment advisors. A number of large investment firms already offer robo-advisor platforms, and more are adding the feature this year or considering doing so.

Certainly, investors are attracted to these platforms because they are relatively low cost and easy to use. And for some investors, especially younger ones with relatively simple investment needs, they provide a real service. However, there are multiple reasons why most people still need human advisors.

For starters, we know our clients. To us, clients aren’t just numbers—they’re like family. We take the time to get to know each and every one of you and your individual circumstances. A good advisor is always on call to help clients through life’s ups and downs. You can’t call a computer when you have a question. And computers don’t know you personally. They certainly can’t offer you a shoulder or a helping hand when you need one. Human advisors can do this, and, in fact, do this quite frequently.

Robo-advisors are designed to help investors with straightforward investment strategies, but many people have more complicated needs. Human advisors, for instance, can be invaluable in helping clients determine tax-advantaged strategies for their personal circumstances. Many of our clients also have complicated family dynamics and inter-generational inheritance issues that computers are ill-equipped to deal with. Computers are good at many things, but the nuances involved in complicated financial matters are best left to a human being.

At Align, we believe robo-advisors have a place in the larger context of financial advice. However, we think it’s a mistake for people to rely on computers as their sole means of financial guidance. As financial advisors, we work closely with you and guide you toward the most appropriate investment decisions for you and your family. Please don’t hesitate to reach out to discuss further how we can best assist you.

The typical financial advisor loves to focus on your investments—after all, most earn sales commissions for selling you stocks, bonds, annuities, or mutual funds.

The typical financial advisor loves to focus on your investments—after all, most earn sales commissions for selling you stocks, bonds, annuities, or mutual funds. MoneyGuidePro clearly illustrates everything from your cash flow to your assets and liabilities. It tracks not just the accounts we manage, but also assets such as bank accounts and loans, all of which can be updated quickly. As a goals based tool, it also records your specific objectives, such as funding college, paying for weddings, buying a home or securing your retirement.

MoneyGuidePro clearly illustrates everything from your cash flow to your assets and liabilities. It tracks not just the accounts we manage, but also assets such as bank accounts and loans, all of which can be updated quickly. As a goals based tool, it also records your specific objectives, such as funding college, paying for weddings, buying a home or securing your retirement.